.jpg)

Commerce is the exchange of goods and services, especially on a large scale.

James Stephenson defines Commerce as " An organized system for the exchange of commodities and distribution of finished productions:"

It signifies a process of exchange, which is the foundation of modem economic life.

✧ Accounting is a systematic and comprehensive process of identifying, measuring, processing, classifying, and recording financial transactions pertaining to an economic entity. It refers to summarize, analyze and record such information to be reported to internal users such as management, employees, and external users, such as investors, regulators, and the oversight agencies or tax officials.

✧ Finance Management is also popularly known as business finance or corporate finances. Financial Management is a managerial activity that is concerned with planning, directing, monitoring, organizing, and controlling the monetary resources of an organization.

✤ In other term, Accounting is reporting financial information using the Generally Accepted Accounting Principle (GAAP) and International Financial Reporting Standards (IFRS). The Financial Accounting Standards Board (FASB), the Financial Reporting Council, the Securities and Exchange Commission (SEC), the IRS, and other regulatory bodies set accounting standards and requirements for accounting preparation and presentation.

✤ As per financial literature, Accounting can be divided into three broad categories:

It deals with the preparation of financial statements and reporting financial information to external users like creditors, government agencies, analysts, investors, bankers, etc. Financial statements, i.e. the income statement and balance sheet indicate the financial position of the business during a given period of time.

Reporting inancial information to internal users like management and employees for the policy-making and running a day to day operations of the business. Management accounting is forward-looking and focuses on future activities to achieve business objectives.

It is a part of management accounting for the cost analysis. Cost accounting makes elaborate cost records regarding various products, operations, and functions. It is a process of determining and accumulating the cost of a particular product or activity.

.jpg)

◎ It refers to the effective and efficient management of monetary resources (finances and economic) by proper utilization of fixed assets and working capital of the organization. Financial management aids management in better decision-making.

◎ Effective procurement and efficient use of finance lead to the proper utilization of monetary resources by the organization. The main objective of financial management is profit maximization and wealth/value maximization.

The major elements of financial management are financial planning and budgeting, financial reporting, accounts record keeping, and financial controls.

It links the objective of an organization to the budget processes of planning and monitoring, and identifying any action needed to the business. Financial management helps to determine the financial requirement of the business which leads to taking financial planning of the organization.

Reporting plays a crucial role in financial management. Since it is internally used by the management of the Company to take a future course of action through the annual accounting statements.

It ensures the proper sources and uses of the economic resources of the organization.

The survival of an organization is an important consideration when the financial manager makes any financial decisions with investment, financing options, and dividends. In addition, it helps in balancing the cash inflows and outflows.

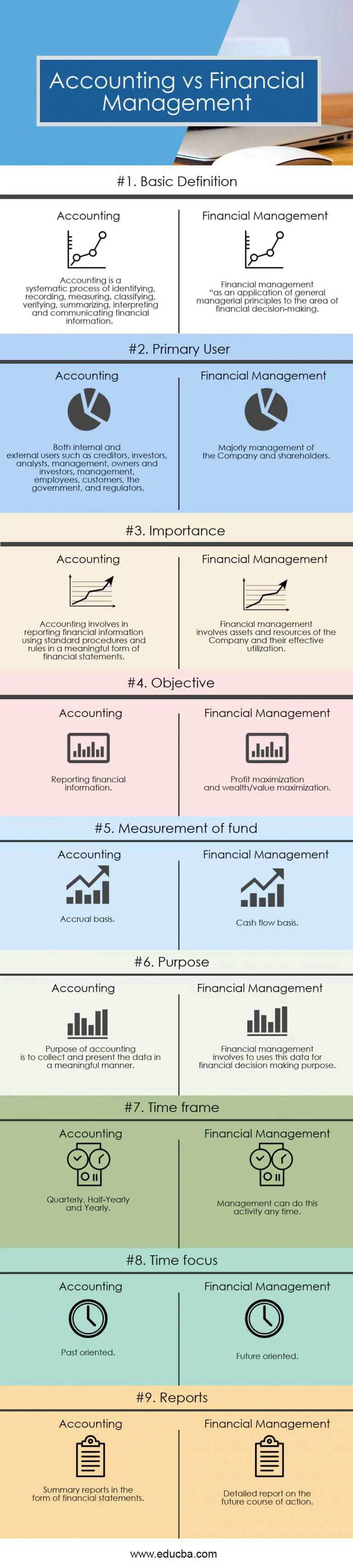

Below is the top 9 difference between Accounting vs Financial Management

Both Accounting vs Financial Management are popular choices in the market; let us discuss some of the major differences:

1. Accounting is more about identifying, measuring, processing, classifying, and recording financial transactions whereas financial management involves the effective and efficient management of finances and economic resources.

2. The key objective of accounting is providing financial information using standard procedures and rules whereas the objective of financial management is profit maximization and wealth maximization.

3. Accounting reports the financial information to both internal and external users such as creditors, investors, analysts, management, and regulators whereas financial management is used internally by the management of the organization for the planning and decision purpose.

4. Accounting has three broad categories – financial accounting, management accounting, and cost accounting whereas financial management is a process with financial planning and budgeting, financial reporting, accounts record keeping, and financial controls.

5. Accounting involves reporting past financial transactions in the meaningful form of financial statements whereas financial management involves planning about the future by analyzing and interpretation of financial statements.

6. Accounting gives the financial position of the Company whereas financial management gives a holistic view of the business activities and provides insight into the future generation of wealth.

7. In accounting, the measurement of a fund is based on an accrual basis whereas treatment of funds in financial management is based on cash flows.

8. Purpose of accounting is to collect and present the data in a meaningful manner whereas financial manager uses this data for financial decision making purpose.

Below is the topmost comparison between Accounting vs Financial Management

| The basis of comparison | Accounting | Financial Management |

|---|---|---|

| Basic Definition | Accounting is a systematic process of identifying, recording, measuring, classifying, verifying, summarizing, interpreting and communicating financial information. | Financial management “as an application of general managerial principles to the area of financial decision-making. |

| Primary User | Both internal and external users such as creditors, investors, analysts, management, owners and investors, management, employees, customers, the government, and regulators.m | Majorly management of the Company and shareholders. |

| Importance | Accounting involves in reporting financial information using standard procedures and rules in a meaningful form of financial statements. | Financial management involves the assets and resources of the Company and their effective utilization. |

| Objective | Reporting financial information | Profit maximization and wealth/value maximization. |

| Measurement of fund | Accrual basis | Cash flow basis |

| Purpose | Purpose of accounting is to collect and present the data in a meaningful manner | Financial management involves to uses this data for financial decision making purpose. |

| Timeframe | Quarterly, Half-Yearly, and Yearly | Management can do this activity at any time. |

| Time focus | Past-oriented | Future-oriented |

| Reports | Summary reports in the form of financial statements | Detailed report on the future course of action. |

In this Accounting vs Financial Management article, we have seen both Accounting vs Financial management play a crucial role in any organization. Accounting is a necessary input for the financial management function of any business. Good financial management is important for the effective utilization of the economic resources of the organization. Accounting restricts up to reporting and summarizing of financial transactions for the external and internal users whereas financial management is about planning, directing, monitoring, organizing, and controlling of the monetary resources of an organization to achieve the objective. Every person or business gets involved in some kind of economic activity. All business carries some kind of economic/financial activity. Accounting and Financial management are related to the extent that accounting is an important input in financial decision-making. Still, they differ in the treatment of funds and with regards to decision-making. Accounting involves preparing and examining past financial records whereas, financial management involves planning to achieve its various financial objectives.